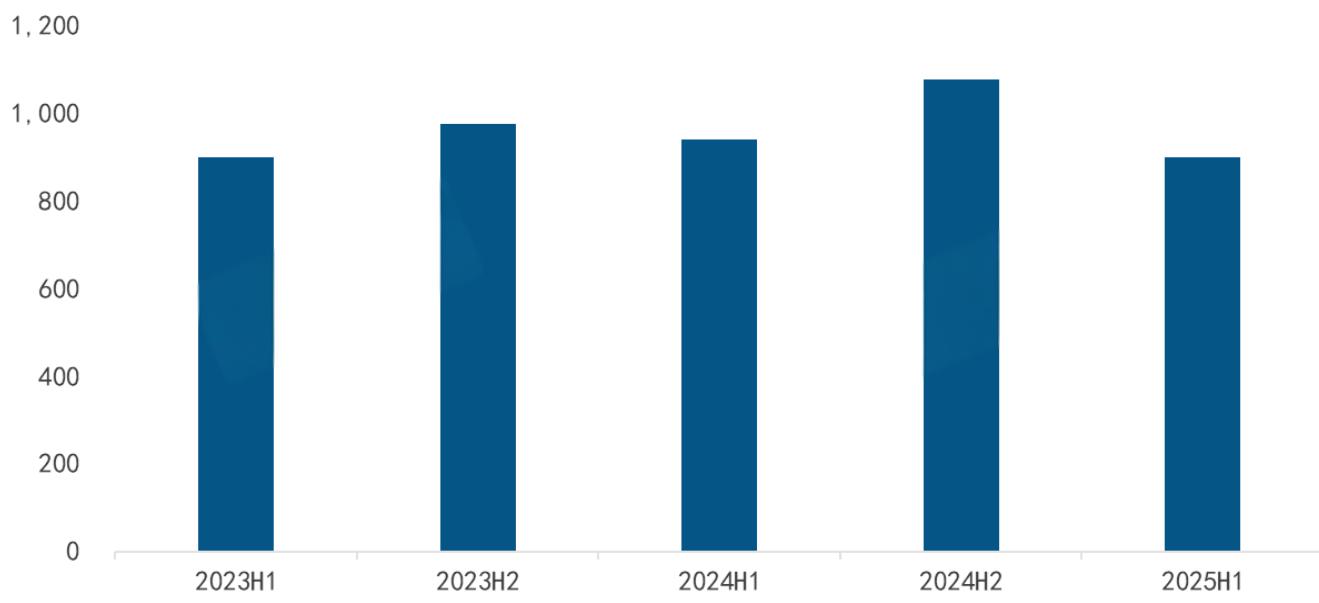

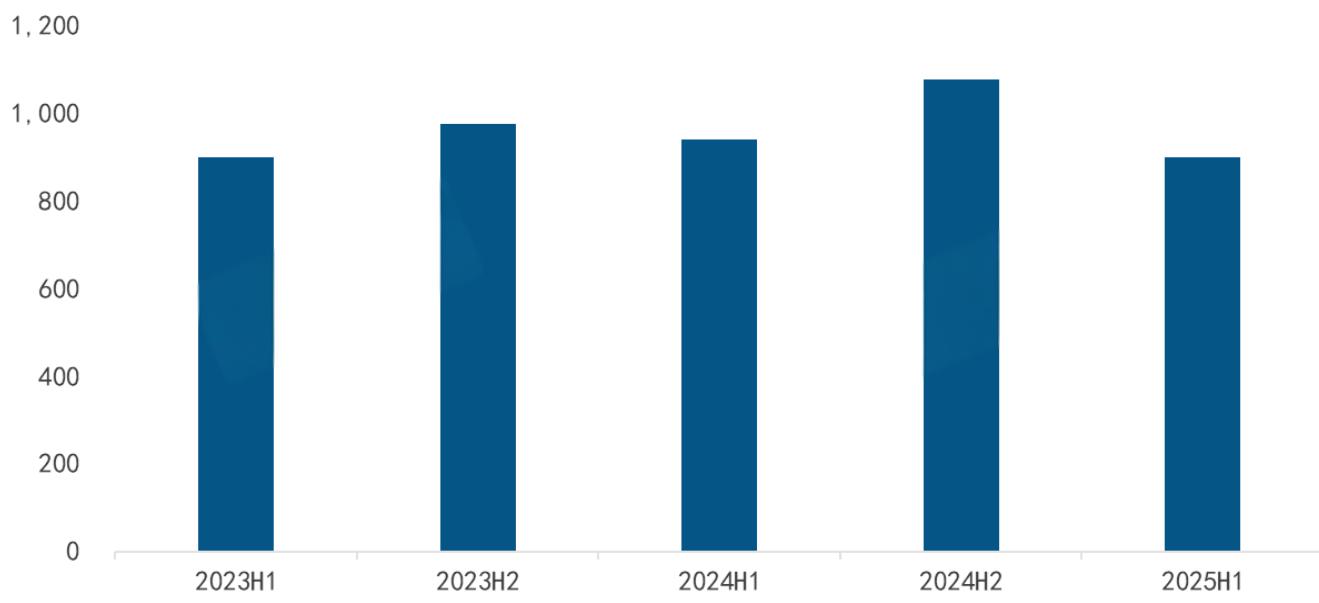

Since 2020, the global projector market has entered a golden growth phase driven by multiple dividends: the rise of the new-generation consumer group has significantly boosted the awareness of smart projectors and mini projectors; cross-border e-commerce has expanded sales channels; and the surge in outdoor camping demand in developed economies – all these factors have jointly promoted the continuous expansion of the market scale. However, this growth momentum hit a critical inflection point in 2025. According to the latest data from RUNTO, the global projector market shipped 9.003 million units in H1 2025, a year-on-year decrease of 4.2%; the sales volume dropped even more sharply by 8.6% year-on-year, reaching only USD 4.05 billion. Faced with downward market pressure, RUNTO has revised down its forecast for the global projector shipment volume in 2025 from 22.08 million units (estimated at the beginning of the year) to 20.34 million units, indicating that the industry is facing challenges of phased adjustment.

Global Projector Shipment Scale (2023 - H1 2025)

I. Three Core Drivers of Market Decline: Tariff Barriers, Fading Sports Event Dividends, and Decline of Low-Cost Products

RUNTO’s in-depth analysis points out that the decline of the global projector market in H1 2025 is the result of the interplay of internal and external factors, which can be summarized into three core contradictions:

1. Tariff Tensions and Geopolitical Conflicts Intensify Market Uncertainty

Turbulent global conditions have become a key factor suppressing the market. On one hand, the Sino-US tariff dispute has caused a two-way impact on the industrial chain: in Q1, some enterprises stockpiled in advance to avoid potential tariff risks, driving a short-term increase in shipments. However, this "rush-to-stock" behavior exhausted Q2 demand, leading to sharp fluctuations characterized by "growth in Q1 and decline in Q2". Meanwhile, tariff costs have been passed on to end-user prices, directly weakening consumers’ purchase ,especially in the mid-to-low-end consumer market. On the other hand, geopolitical conflicts in the Middle East and Eastern Europe continue to escalate, disrupting international trade order. This not only causes volatility in regional market demand but also makes enterprises cautious about long-term investments, further suppressing market vitality.

2. "High Base Effect" of Sports Events Emerges, Lacking Demand Support

2024 was a "big sports year", with major global events such as the Paris Olympics and the European Cup held intensively in H1. These events effectively stimulated demand for home entertainment (home viewing) and commercial display (event promotion, venue projection), laying a high base for the market. In contrast, H1 2025 lacked global sports events of the same scale, making it difficult to replicate the previous year’s demand peak. The "fading of sports event dividends" has become a key factor dragging down shipment volume, especially in the home projector consumption scenario where demand has declined significantly.

3. Decline of Low-Cost "$99 Barrel Projectors", Losing Growth Engine

The low-cost "$99 barrel projectors", which once dominated the mid-to-low-end market, saw a significant decline in momentum in H1 2025. Previously, these products quickly penetrated the sinking market with their low-price advantage. However, as e-commerce platforms adjusted their algorithms (reducing traffic support) and user negative feedback increased (such as poor image quality, insufficient battery life, and low durability), their market appeal has continued to decline. Gradually, they have lost their role as the core driver of overall shipment volume, leaving the mid-to-low-end market stuck in stagnant growth.

Global Projector Market Shipment Scale (2023 - H1 2025)

II. Intensified Regional Market Differentiation: Developed Markets Resist Decline, China and Asia-Pacific Under Pressure

From a regional perspective, the global projector market in H1 2025 showed a pattern of "developed markets achieving slight growth against the trend, while emerging markets showing differentiation". Different regions exhibited distinct characteristics due to differences in economic environments and policy orientations:

1. China Market: Declining Share + Fading Subsidy Effect, Becoming a Major Drag

As the world’s largest projector sales market, China showed weak performance in H1 2025: with shipment volume reaching 2.85 million units, a year-on-year decrease of 13.5%; its share in the global market dropped from 35.1% in H1 2024 to 31.7%. Notably, among the categories covered by China’s domestic consumer subsidy policies, projectors are one of the rare categories with declining sales (smart TVs also underperformed during the same period). Moreover, as the intensity and effectiveness of subsidies continue to weaken, the market faces significant pressure for recovery in the future, and a noticeable rebound is unlikely in the short term.

2. North American Market: Resilient High-End Demand, Slight Overall Growth with Quarterly Volatility

Ranking as the world’s second-largest market (with a 21.5% share), North America achieved a shipment volume of 1.937 million units in H1 2025, a slight year-on-year increase of 1.3%, but its quarterly performance showed obvious divergence: driven by enterprises’ "panic stockpiling" in Q1, shipments rose by 5.6% year-on-year; however, demand returned to rationality in Q2, leading to a 2.3% year-on-year decline in shipments. Nevertheless, the high-end demand in the North American market remains resilient – the shipment volume of 4K laser projectors surged by 70.6% year-on-year, becoming the core driver of market growth and highlighting the importance of high-end transformation.

3. Western European Market: Surpassing Asia-Pacific to Become the Third-Largest Market, Driven by Commercial Demand

Since Q4 2023, the Western European market has surpassed Asia-Pacific to become the world’s third-largest projector market. In H1 2025, Western Europe’s shipment volume reached 1.804 million units, a year-on-year increase of 8.0%. Despite the fading popularity of low-cost "barrel projectors", the EU’s increased investment in school digitalization has driven demand for laser short-throw projectors in commercial scenarios (especially in the education sector), providing solid support for market growth. The commercial market has thus become the core engine of regional growth.

4. Asia-Pacific and Emerging Markets: Significant Differentiation, Resilience in Some Regions

Asia-Pacific Market: Overall Pressure

In H1 2025, the Asia-Pacific market faced overall pressure, with shipment volume of 1.484 million units, a year-on-year decrease of 7.3%. Among sub-regions: demand in mature markets such as Japan and South Korea remained relatively stable; although Vietnam and Thailand benefited from manufacturing dividends brought by foreign investment relocation, tightened consumer spending restrained local demand; India, leveraging its demographic dividend, achieved a counter-trend growth of 9%, becoming the only major market in the region with positive growth and demonstrating strong potential.

Other Emerging Markets

- Latin America: A year-on-year decline of 11%. Among them, Brazil’s projector shipments grew due to the accelerated penetration of cross-border e-commerce, while Mexico was dragged down by the repeated changes in the U.S. "$800 duty-free" policy, which severely disrupted cross-border supply chains.

- Eastern Europe and MENA (Middle East and North Africa): Delivered outstanding performance, with year-on-year growth of 17% and 7% respectively. Market demand in Russia and the United Arab Emirates showed a noticeable recovery, becoming "growth highlights" among emerging markets.

Global Projector Market Shipment Structure by Region (2024 - H1 2025)

III. All Technology Routes Under Pressure, 1LCD’s Share Nears 70% but Hidden Risks Loom

In H1 2025, the shipment volume of all projector technology routes declined, and the market structure underwent further adjustments. Although 1LCD maintained its dominant position, its low-end orientation and inventory pressure intensified:

1. 1LCD: Share Rises to 69.6% Against the Trend, Low-End Orientation and Inventory Pose Hidden Risks

In H1, 1LCD products shipped 6.266 million units, a slight year-on-year decrease of 0.8%, but its market share increased from 67.2% in H1 2024 to 69.6%, remaining the absolute mainstay. However, the growth of this technology route hides hidden risks: on one hand, the declining momentum of barrel projectors directly affects the overall shipment of 1LCD products; on the other hand, 1LCD products are mainly low-end models, and the increase in negative user feedback (such as poor image quality and insufficient durability) has led to a simultaneous rise in enterprise inventory backlogs and channel return rates. The subsequent inventory digestion pressure is relatively large, and long-term growth momentum is insufficient.

2. DLP: Professional Advantages Fail to Offset Weak Demand, Delayed Core Components Drag Performance

DLP products shipped 1.914 million units in H1, a year-on-year decrease of 9.6%. Although DLP still has technical advantages in the professional engineering projection field (large venues, exhibition displays), the overall weak market demand has offset this advantage. In addition, the delayed delivery of Texas Instruments’ 0.39-inch 4K UHD light valves has further affected the launch schedule of high-end DLP models, restricting market performance and hindering the high-end transformation process.

3. 3LCD: Stable Home Demand Fails to Compensate for Commercial Gap, Shipment Decline Widens

3LCD products shipped 811,000 units in H1, a year-on-year decrease of 14.4%, making it the category with the largest decline among the three mainstream technology routes. Although 3LCD demand in the home projector market (home theaters) remained relatively stable, the demand in commercial scenarios (conference rooms, education and training) declined significantly, and the growth in the home segment failed to fully compensate for this gap. As a result, the overall shipment came under pressure, and its market share continued to shrink.

4. Emerging Technologies: 2LCD and Domestic LCoS Fail to Gain Traction, Unable to Support the Market

In H1, end products equipped with 2LCD technology were officially launched in the Chinese mainland market, but sales volume was extremely low; the launch of domestic LCoS solutions was delayed, failing to enter the market in a timely manner. The combined shipment share of these two emerging technology products was only 0.13%, making it difficult for them to provide effective support to the market in the short term. They have not become a new driver of industry growth, and technological innovation has not been converted into market competitiveness.

Global Projector Market Shipment Structure by Projection Technology (2024 - H1 2025)

IV. Light Source Structure: LED Stable, Laser Growing, Bulb Declining – Laser Becomes Core Growth Driver

In H1 2025, the projector light source structure showed distinct characteristics of "stable LED, growing laser, and declining bulb". Laser light sources became the only category to achieve positive growth, driving the industry towards high-quality development:

1. LED Light Source: Stable Share, Remains Mainstream but Growth Stagnates

In H1, LED light source products shipped 7.11 million units, a year-on-year decrease of 3.2%, but its share remained at 79.0%, a slight year-on-year increase of 0.8 percentage points, still the mainstream light source in the market. However, LED light sources mainly rely on mid-to-low-end products, and affected by the decline of barrel projectors, their growth has stagnated. In the short term, they will continue to maintain a pattern of "stable share and slight sales decline".

2. Laser Light Source: Counter-Trend Growth of 7.7%, Becoming the Core Growth Driver

Laser light source products shipped 1.055 million units in H1, achieving a counter-trend year-on-year growth of 7.7%, with a share of 11.7%, an increase of 1.9 percentage points year-on-year, becoming the core driver of market growth. From a market performance perspective, laser products grew faster in overseas markets than in China, and the pace of replacing mercury lamps with lasers has accelerated significantly. Traditional projection brands such as Optoma, Panasonic, BenQ, and ViewSonic have intensively launched and shipped laser products. In the commercial market, the high-brightness advantage of lasers stands out in the uncertain market environment, with a penetration rate of 33.8%, an increase of 3.6 percentage points year-on-year.

In the segmented market, the share of three-color lasers increased from 31.3% in H1 2024 to 33.5%, and the share in the Chinese market reached as high as 60.4%, highlighting the demand potential for high-end laser products in China. Three enterprises – Hisense, Nuts, and XGIMI – contributed more than 70% of the global three-color laser market share, with leading enterprises dominating the high-end transformation of the industry.

In addition, the 2025 Laser Display Technology and Industry Development Conference will be grandly held in Qingdao on September 19th. RUNTO will jointly release the 2025 Projection Display Screen Industry White Paper with institutions including the Video Industry Association, the University of Science and Technology of China, Feist, and Haifei. The white paper aims to reshape the industry’s cognitive biases, emphasize the important value of screens in high-quality projection displays (especially in laser display systems), and promote the healthy development of the laser display industry.

3. Bulb Light Source: Shipment Drops by Another 21.7%, Gradually Withdrawing from the Stage of History

Bulb light sources only shipped 839,000 units in H1, a further year-on-year decrease of 21.7%; their shipment share was 9.3%, falling below 10% for the first time. As the EU’s 2026 mercury ban approaches, mainstream manufacturers are gradually stopping the production of mercury lamp models. After the channel inventory is cleared, bulb light sources may completely withdraw from the projector industry, completing their historical mission.

Global Projector Market Shipment Structure by Projection Light Source (2024 - H1 2025)

V. Full-Year Forecast Revised Down to 20.34 Million Units, Three Positive Signals for H2

RUNTO’s analysis suggests that the market decline in H1 2025 reflects, to a certain extent, the vulnerability of the projector industry under external pressure. Given its non-essential attribute, products need to improve their overall performance and reputation to enhance their value in quality life and break through growth bottlenecks.

Based on the current market situation, RUNTO has revised down its forecast for the global projector shipment volume in 2025 from 22.08 million units (estimated at the beginning of the year) to 20.34 million units. At the same time, it points out that there are three positive signals in the market in H2, which are expected to ease downward pressure:

- Consumer Side: The arrival of holiday consumption seasons (such as Christmas and Black Friday) is expected to stimulate demand for home projectors;

- Regional Side: Stable supply in the North American market, concentrated release of education bids in Western Europe, and sustained demand in emerging markets will become the main forces against the decline;

- Product Side: High-end products such as laser and 4K projectors are not only the core engines of shipment growth but also the key drivers of industry structure upgrading, promoting the market towards high-quality development.